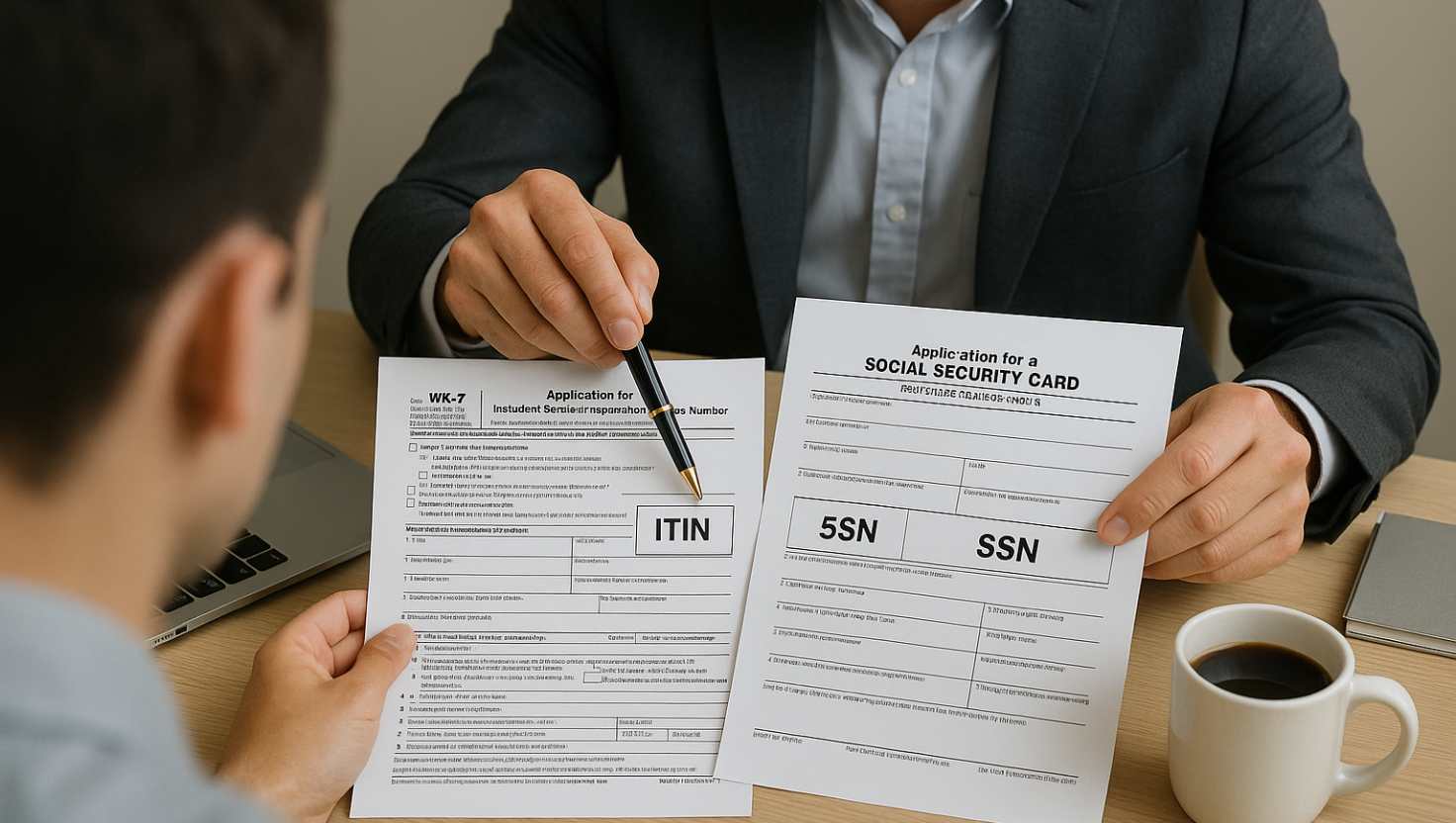

In the United States, the ITIN (Individual Taxpayer Identification Number) and the SSN (Social Security Number) are both used for identification and tax purposes, but they apply to different groups of people. Understanding ITIN vs SSN is key to knowing which one you need, how each works, and what role they play in taxes and financial opportunities. In this article, we explain the main differences and when each is required.

When to Use an ITIN

Knowing when to use an ITIN is essential for many individuals who find themselves in complex tax situations. I once spoke to a friend who was living in the U.S. on a temporary work visa, and she was worried about how to file her taxes. That’s when I learned that she qualified for an ITIN, as she was earning income but lacked an SSN. When you’re in a similar boat, using an ITIN allows you to file taxes legally, ensuring you meet your obligations and potentially qualify for tax benefits, like education credits. It’s especially useful for non-residents or anyone on a visa who has income generated in the U.S.

It’s worth noting that an ITIN does not affect your immigration status, but it does keep you on the right side of the tax law. So if you’re navigating the financial landscape without an SSN, an ITIN is your trusty companion. Just make sure to keep your documentation in order to support your ITIN application and tax filings until you can hopefully upgrade to an SSN in the future.

What is an SSN?

A Social Security Number, or SSN, is a nine-digit number issued by the Social Security Administration. It’s often thought of as the golden ticket to many aspects of life in the U.S. When I got mine as a teenager, it felt like a rite of passage. The SSN is used for tracking individuals for Social Security benefits and for tax purposes—basically, it’s your personal financial identifier. Unlike an ITIN, which is designed for those who are ineligible for an SSN, the SSN is issued mainly to U.S. citizens and some eligible non-citizens. The importance of the SSN can’t be overstated; it’s used to open bank accounts, apply for credit cards, and even secure jobs.

Employers generally require it during the hiring process, emphasizing its role in the workforce. However, if a Social Security Number is misused, it can lead to identity theft, which is something everyone should be cautious about. Understanding how an SSN works compared to an ITIN can really empower individuals in their financial and personal choices. Remember, it’s not just a number; it’s a cornerstone of your identity in many ways.

When to Use an SSN

Using an SSN is quite straightforward for most U.S. citizens and eligible residents. If you’re employed or plan to engage in any formal economic activity, having an SSN is crucial. I remember my first job—my employer told me right away, ‘You need to provide your SSN.’ It felt like a big step into adulthood! An SSN is required not only for employment but also for things like applying for loans, credit cards, and social services.

It acts as a gateway into numerous financial networks. If you are employed, your employer will report your earnings using your SSN to the IRS, linking it to your tax obligations. Furthermore, having an SSN gives you the right to access various government benefits like Social Security when you retire. However, it’s very important to keep your SSN secure to prevent identity theft. So, if you’re eligible for one, don’t take your SSN lightly—treat it like the valuable asset it is! Just be sure you understand when and where to provide it for safety and security.

Common Misconceptions

There are quite a few misconceptions surrounding ITINs and SSNs that can confuse even the most diligent individuals. One common misconception is that having an ITIN means you’re in the United States illegally. I once had a long chat with a friend who thought this; he was worried that getting an ITIN would put him on some sort of watch list. But in reality, many legal residents and non-residents use them for tax purposes. Similarly, I’ve encountered people who believe an SSN ensures you have proper work authorization when it doesn’t guarantee you a job. Employers still verify eligibility to work through other means, even with an SSN.

It’s crucial to dispel these myths because they can deter people from applying for what they need. Another myth is that you can use an ITIN for things an SSN can do, like securing a job—which is false. Educating oneself about these numbers enhances understanding and promotes a smoother experience in financial matters. So take the time to clarify any doubts, ask questions, and learn about what benefits your situation provides.

Key Differences Between ITIN and SSN

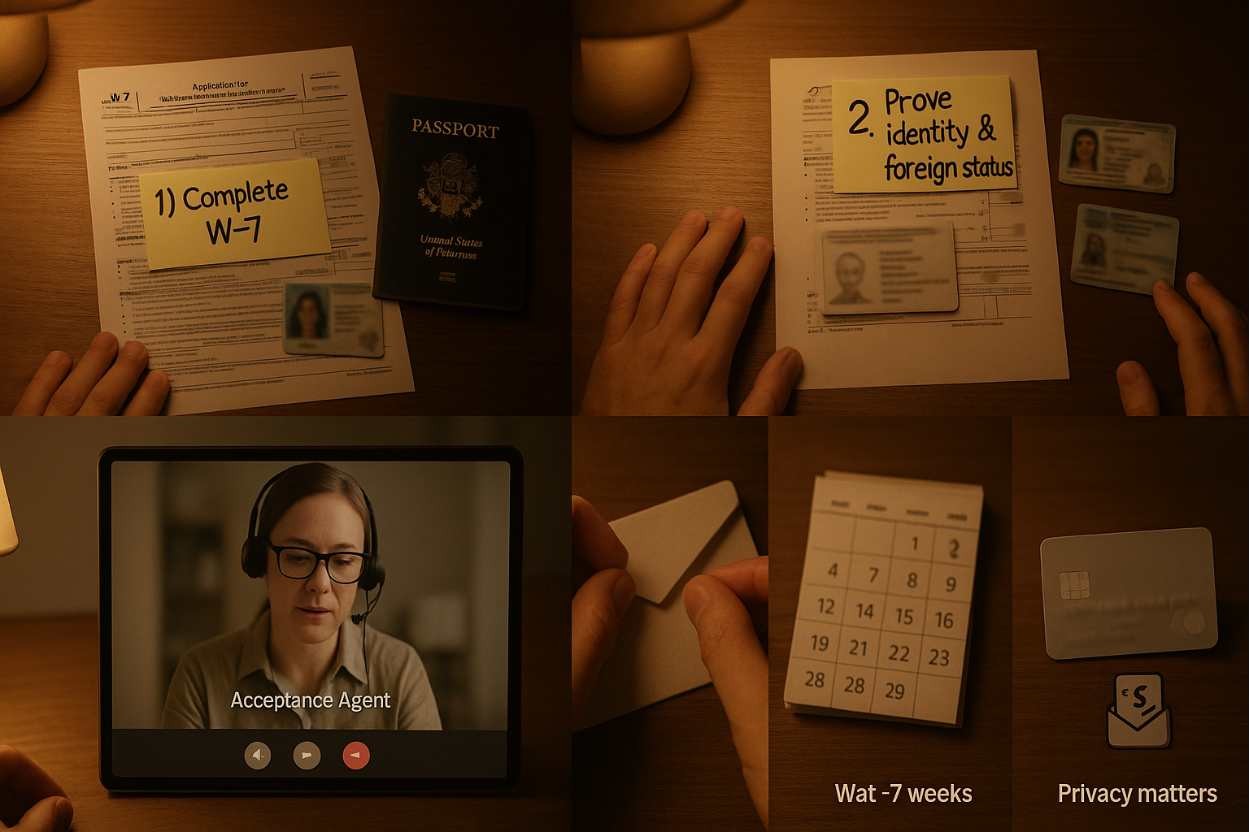

When you look closely at ITINs and SSNs, you’ll see several noteworthy differences. First off, an SSN is primarily for U.S. citizens and some eligible non-citizens, while an ITIN is aimed at individuals who need to file taxes but do not qualify for an SSN. I found that many people were surprised to learn that an ITIN doesn’t provide work authorization; it’s solely for tax purposes. On the flip side, holding an SSN does grant you the right to work legally in the United States. Another crucial difference is that the IRS issues ITINs, while the Social Security Administration issues SSNs.

Also, when it comes to government benefits, an SSN is your ticket to access many programs, but an ITIN will not give you the same privileges. It can get a bit confusing trying to navigate all this, especially if you’re new to the U.S. or dealing with tax regulations. It’s always a good idea to stay informed about both numbers and how they fit into your life, as knowing the differences could save you from future headaches.