Your ITIN (Individual Taxpayer Identification Number) may expire if it hasn’t been used in recent years or if the IRS phases out certain number ranges. To avoid issues when filing your tax return, it’s important to understand the renewal process. This ITIN renewal guide explains when you need to renew, which documents are required, and the steps to keep your ITIN valid and active with the IRS.

Common Application Mistakes

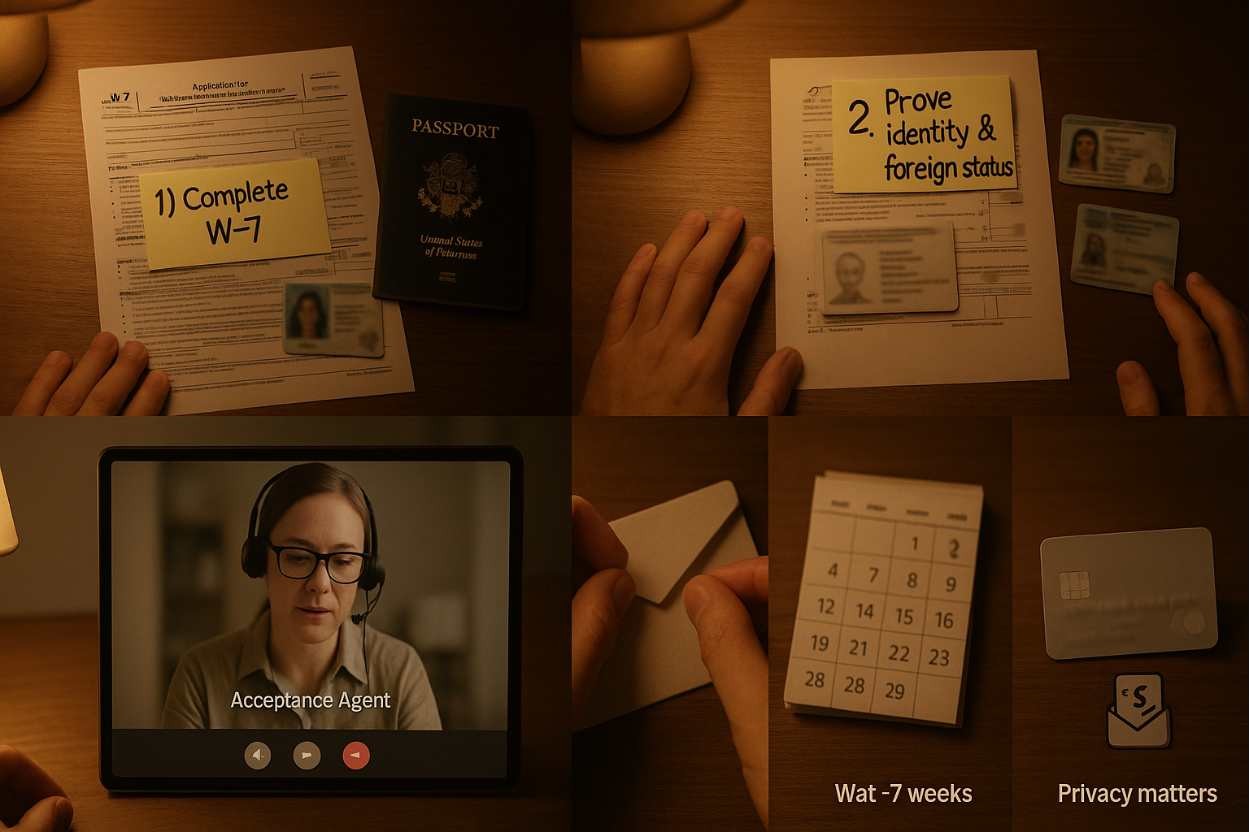

As with many forms, there are common pitfalls people encounter when applying for an ITIN. I remember speaking with someone who submitted their application only to be rejected for forgeting to include a supporting document. It was a simple oversight, but it set them back weeks! Missing documents, incorrect personal information, and failing to sign the application are just a few key mistakes that can cause delays. Plus, not using the correct Form W-7 can lead to a heap of confusion. I can’t help but shake my head thinking about how often this happens. One of my neighbors shared her experience, and she had to resubmit three times before finally getting it right!

To avoid these headaches, take the time to review every part of your application before hitting send. You might even consider having someone else look over it. A fresh set of eyes can catch any errors or omissions you might have missed. It’s all about taking that extra precaution to make the process as smooth as possible.

Typical Processing Times

So, how long does it actually take to get an ITIN? Generally, the IRS states that processing an ITIN application can take about 7 weeks. That’s not too long, right? However, I’ve heard stories from friends and family about their experiences that varied quite a bit. For example, one of my friends submitted his application and it went through within a month, while another took nearly three months to hear back. It’s a little frustrating when you’re waiting on such essential paperwork and your plans hinge on that timeline.

Factors that might influence the processing time include the time of year you submit your application, the volume of applications the IRS is handling, and whether there are issues with your documentation. Sometimes, it feels like you’ve submitted everything correctly only to find out you missed one little part, which can lead to delays. Keeping track of your application and following up with the IRS can be crucial to ensure everything is moving along as it should. A little patience can go a long way during this process.

Tracking Your Application Status

Wondering how to keep tabs on your ITIN application? It can be a bit of a waiting game, but tracking your application is easier than you might think. After you submit, you can call the IRS to inquire about the status of your ITIN application. Just be prepared with all your relevant information when you do! I once called them up, and although the wait on hold was a bit long, the representative was able to give me an update and restore my sanity.

Also, don’t forget about the confirmation you receive after submitting your application; it usually contains key details you might need if there’s any kind of follow-up. Depending on the time of year, be patient, as the IRS handles countless cases. And if you find it’s been longer than the usual processing time, don’t hesitate to reach out! Keeping a proactive approach can really ease your worries while waiting for your number. That peace of mind is well worth the effort.

What to Do When Delayed

It can be incredibly frustrating when you’re waiting longer than expected for your ITIN, but there are steps you can take if delays occur. If weeks turn into months, it might be time to call in for some backup. Reach out to the IRS directly; having your application details on hand will make this process a lot smoother. Interestingly, I learned that the IRS has a specific system in place for dealing with inquiries about delayed applications. One approach I recommend is to first check if there are any updates on the IRS website regarding processing times or delays. Oftentimes, they provide current information that could ease your mind.

In addition, keep all correspondence organized—having a record can be invaluable if you have to escalate your inquiry. Sometimes, simply showing that you are monitoring the situation can fast-track things. If things still don’t work out, you might want to consider getting help from a tax professional or an acceptance agent who can provide additional support. After all, you shouldn’t feel like you’re in this alone during a stressful wait!

Tips for Faster Processing

Want to speed up your ITIN application process? There are a few proactive steps you can take! First off, make sure to double-check your application for any errors. I once submitted a form with a minor typo, and it ended up delaying everything. It’s like the IRS has a keen sense for spotting those tiny mistakes! Additionally, submitting your application during the off-peak seasons could help. Tax season, especially, is typically when the IRS sees a flood of applicants.

By sending in your ITIN request during quieter times, like the summer or early fall, you might just get your number faster. Another tip is to use the IRS’s certified acceptance agents. Getting assistance from someone who’s familiar with the process can make a world of difference. These agents can help ensure your paperwork is in order from the beginning, preventing any potential bumps in the road. Having the right support can definitely ease your anxiety about waiting. The goal is to get your ITIN and move on with your life, so these steps can make it so much more manageable.