Foreign individuals who earn income in the U.S. but are not eligible for a Social Security Number may need an ITIN (Individual Taxpayer Identification Number). Applying for an ITIN for non-resident aliens ensures compliance with IRS requirements, allowing them to report income and file tax returns properly. In this article, we explain who qualifies, what documents are required, and the steps to apply successfully.

Key Benefits of Having an ITIN

There are several benefits you can enjoy once you have an ITIN. Foremost, it allows you to file a U.S. tax return, which is essential for anyone making money in the country. There’s a sense of legitimacy and peace of mind that comes with being able to report your income correctly. Plus, having an ITIN might make it easier for you to access certain financial services such as opening a bank account or applying for loans. I recall a time when my friend Sam, who was a non-resident, faced hurdles without an ITIN when trying to set up a bank account—they wouldn’t process it without a valid identification number.

Having an ITIN potentially opens doors to tax credits and refunds, too! I was surprised to learn just how financial opportunities multiply with the right identification. So, in essence, having an ITIN isn’t just a box to check off; it’s like a gateway that can make life a whole lot simpler in the U.S.

Who Needs an ITIN?

So, who exactly needs an ITIN? Non-resident aliens, their spouses, and children may need this number. Basically, if you’re a foreign national earning money in the U.S., there’s likely a need for an ITIN. For instance, I remember a friend from college who worked part-time while pursuing his studies and, subsequently, faced challenges during tax season due to his lack of an ITIN. There are also specific circumstances where individuals might need one, such as real estate transactions or those claiming dependents.

If you’re in the U.S. for short-term work or in a different capacity, a tax identification number grants you the ability to report your income accurately. You’ll often see documentation requirements through forms like the W-7, which outlines everything necessary to apply for an ITIN, keeping everything on the up and up with the IRS. All in all, if you’re thinking you’ll earn income subject to U.S. tax, don’t overlook the importance of applying for an ITIN.

Common Mistakes When Applying

Applying for an ITIN can be tricky, and many make common mistakes that could delay their application. One frequent issue is submitting incomplete forms. I learned that firsthand when I forgot to provide a crucial document at one point! Always double-check that everything is filled out correctly, including your W-7 form and all supporting documents. Another common pitfall is using incorrect or outdated documents for verification—so ensure that they’re still valid! Many applicants also don’t consider mailing times and get frustrated with the wait, but sometimes, it just takes a little longer than expected. Additionally, there might be confusion about filing for dependents.

If you’re not sure if they need an ITIN too, it’s better to ask than make an assumption. If you’ve got an Acceptance Agent involved, they can help track things and reduce the likelihood of mistakes. Keeping track of your application status can also help you navigate potential bumps along the way. Awareness of these obstacles can save some headaches down the road!

Maintaining Your ITIN

Once you have your ITIN, it’s important to know how to maintain it properly. Keep in mind that if you don’t use your ITIN on a tax return for three consecutive years, it may expire! Imagine having all that work for naught simply because you didn’t file your taxes in time. Remaining compliant with the IRS rules is essential to ensure your ITIN remains active. I always tell my friends that they should keep an eye on deadlines and file their taxes annually, regardless of income, because that’s just smart. Also, if your personal information changes, like your name or address, you need to update your ITIN details promptly—don’t leave that until the last minute! Any discrepancies can lead to issues down the line.

Staying in the loop with IRS updates or changes in tax regulations affecting non-residents can save you stress, too. And just like anything else in life, regular check-ins can help keep everything running smoothly. By being proactive, you ensure your ITIN remains a helpful asset.

How to Apply for an ITIN?

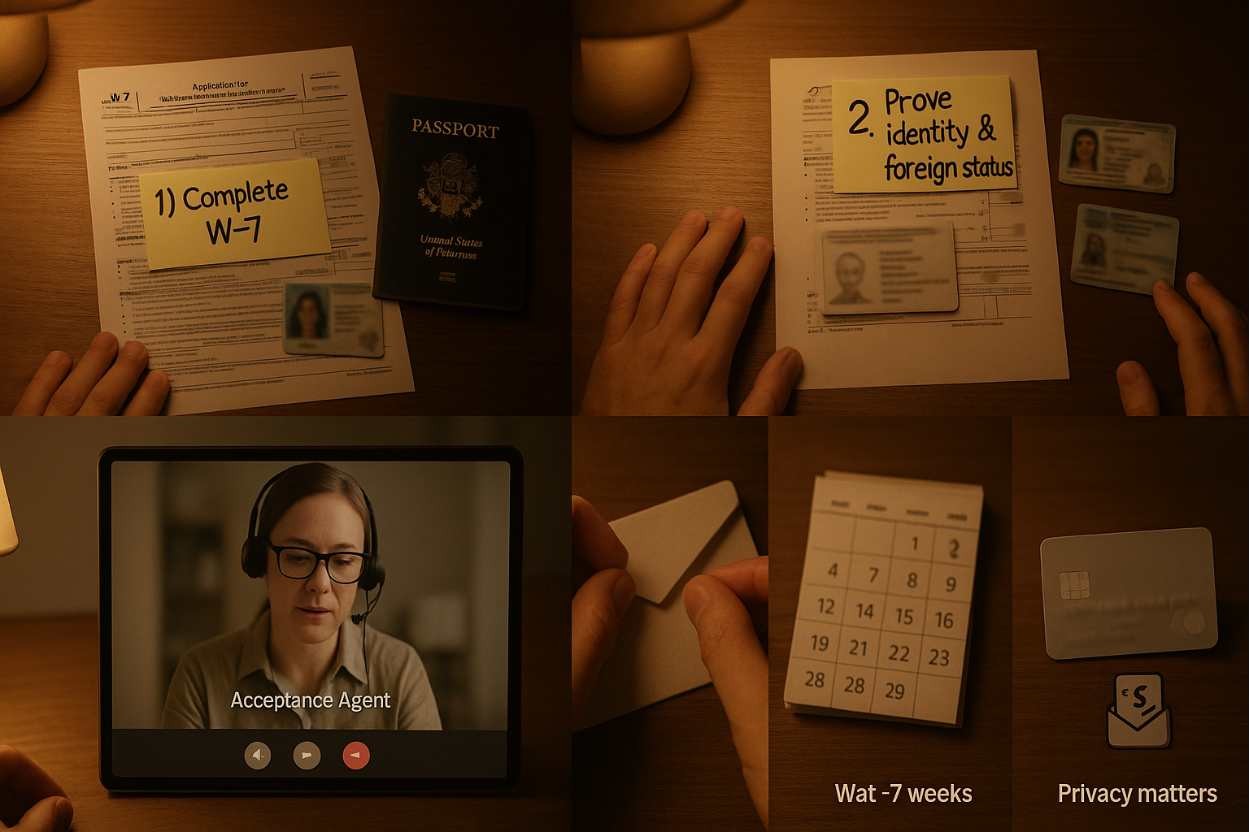

Applying for an ITIN might sound complicated, but it’s actually manageable once you get into the groove of it! First, you’ll need to fill out Form W-7, providing personal identification details. I remember the first time I did this; it felt like a big step, but also a relief to have things sorted. You must also attach original documents—or certified copies—that validate your identity and foreign status. The IRS is pretty strict about this part, so make sure your documents are correct. Next, you can submit the W-7 form along with your tax return to the IRS for processing.

Alternatively, some people choose to file it through an Acceptance Agent, which can help streamline the process. Just be sure keep an eye on everything—application processing times can vary, and patience will be key. Don’t forget to follow up, as you can typically expect to receive your ITIN within a few weeks. It’s a small step in the grand scheme, but it opens a lot of doors for non-residents navigating the tax landscape.