If your children or other relatives are not eligible for a Social Security Number but must be included on your U.S. tax return, they may need an ITIN (Individual Taxpayer Identification Number). Applying for an ITIN for dependents ensures they are recognised for tax purposes, allowing you to claim them, file correctly, and access possible tax credits. In this article, we explain who qualifies, what documents are required, and how to complete the application successfully.

Claiming Dependents with ITIN

So, let’s talk about the perks of having an ITIN especially when it comes to dependents. With your ITIN, you can actually claim your dependents when filing taxes, which could result in some sweet tax credits. For example, the Child Tax Credit is one that can really boost your refund, but you need to have your dependents documented correctly to reap those benefits. I remember one year, a close friend of mine didn’t include her child as a dependent because she thought it would be too complicated. But once she got her ITIN, everything changed! She found it so easy to file and ended up getting a dollar amount back that made her whole tax season worthwhile.

It’s such a great relief to know you can potentially lower your tax liability just by correctly claiming your dependents. So if you’re worried about your dependents being left out of this, breathe easy! Just follow the steps, gather all necessary documents, and you’ll be on your way to maximizing your tax refund.

Who Needs an ITIN?

Now, you might be asking yourself, do I really need an ITIN? The answer depends on your situation. Basically, if you don’t qualify for an SSN, but you need to file taxes or be claimed as a dependent, an ITIN is your go-to solution. This also applies to your family members who might be residing in the U.S. without an SSN. I remember helping my cousin Sam, who’s working in the U.S. but still had family back in his home country.

He was confused about his filing obligations and wanted to claim his siblings who were dependents. I told him about the ITIN process and how it could benefit him greatly not just to file taxes but also to ensure his dependents are covered under the tax law. People often overlook this detail, thinking only about their own tax responsibilities. But including your dependents can sometimes lead to bigger refunds or credits, making the ITIN even more valuable. In short, if you wanna play fair in the tax game, knowing whether you need an ITIN is crucial.

Benefits of Having an ITIN

Having an ITIN opens up a world of opportunities, especially when it comes to financial matters in the U.S. Beyond just filing taxes, it allows you to establish a credit history, which can be crucial for financial stability. Few people realize they can build their credit score even without an SSN, which is such an advantage in this day and age. I once invited a friend over who shared how her ITIN helped her get a secured credit card that was really a game changer for her.

Additionally, those with ITINs can often access certain banking services, loans, or rental agreements, making life a little bit easier. Also, for anyone worried about their dependents, having this number allows you to get health coverage as well. It’s like a secret key that unlocks various services that you might not think are accessible. So taking the time to get an ITIN is well worth it, as it sets a solid foundation for your financial future, both for you and your dependents.

Common Mistakes to Avoid

Like any process, applying for an ITIN has its share of pitfalls that you should be aware of. One common mistake people make is filing for an ITIN too late. As I’ve mentioned, timing is everything! Definitely keep an eye on the tax deadlines to avoid any unnecessary stress. Another mistake is providing incorrect or incomplete documentation. Trust me, double checking your application saves a lot of time; nobody wants delayed processing! Keep your personal information organized by preparing all necessary documents from the start. Also, some folks think they can use an ITIN to work in the U.S., but that’s a hard no!

An ITIN isn’t a work permit; it’s solely for tax purposes. Misunderstanding this can lead to legal troubles. Lastly, many people forget that an ITIN must be renewed after a certain period, particularly if it hasn’t been used in three consecutive years. So, mark your calendars! As long as you stay informed and keep these common mistakes in mind, the process of getting and maintaining your ITIN will be a breeze!

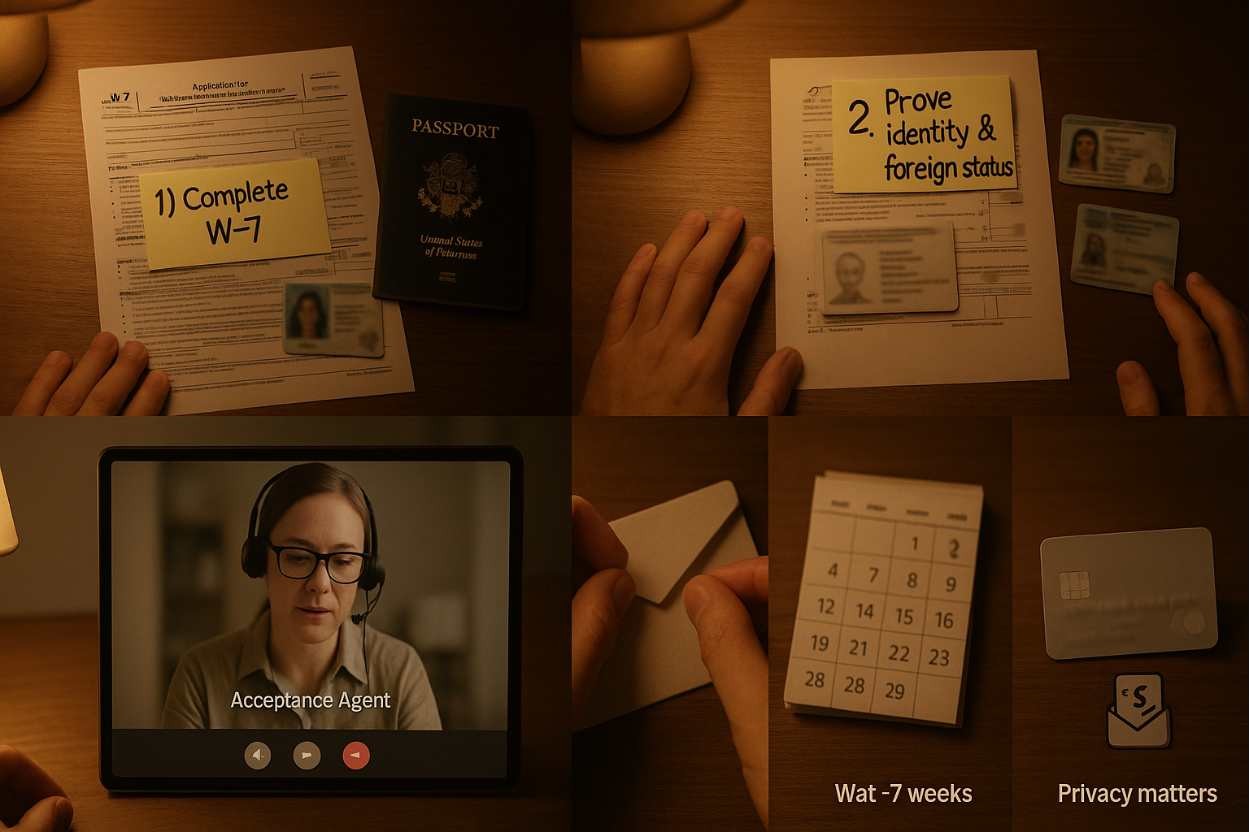

How to Apply for an ITIN?

Applying for an ITIN may sound daunting, but once you break it down, it’s totally manageable! The process usually starts with filling out Form W-7, the application for an Individual Taxpayer Identification Number. You can find that form on the IRS website—super user-friendly, I promise! I remember feeling lost when I first helped a friend navigate this. But patience definitely paid off!

You’ll also need to provide documents that prove your foreign status and identity, like a passport or a national ID card. Once you have everything ready, you can send your application in by mail or apply in person at designated IRS Acceptance Agents. Just keep in mind that it may take a while to process—up to 7 weeks sometimes. So, if you’re planning on filing taxes, don’t leave it to the last minute. It’s best to apply early. It’ll save you from future headaches, trust me! Lastly, once you get your ITIN, hang onto it tightly; it’s your golden ticket for tax purposes for years to come!