Normally, the IRS requires applicants to attach a federal tax return when requesting an ITIN (Individual Taxpayer Identification Number). However, there are certain exceptions. Knowing how to apply for an ITIN without a tax return is essential if you qualify under categories such as dependents, certain visa holders, or individuals claiming treaty benefits. In this article, we explain the IRS-approved exceptions, the documents required, and the steps to apply successfully.

Required Documents for ITIN

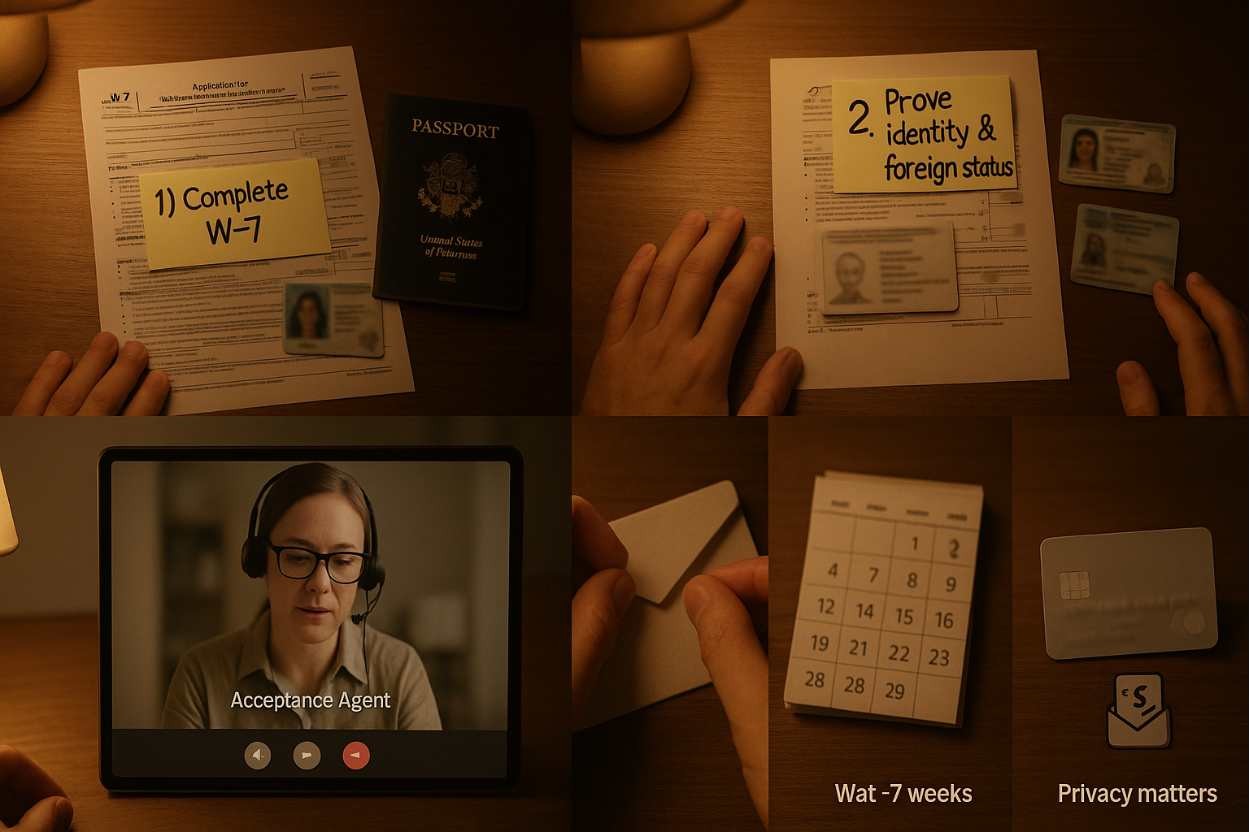

When considering your ITIN application, you’ll want to make sure you gather the right documents, right? As I mentioned before, you’ll need Form W-7, but that’s just the tip of the iceberg. You also need to include documents that prove your identity and foreign status. A passport is usually the best bet since it’s globally recognized. Alternatively, you can provide a combination of other paperwork like an alien registration card, a national identification card, or even a birth certificate.

It’s so crucial to make sure that your documents are in good condition and clearly readable, because the last thing you want is a delay due to poor documentation. I once thought a crumbled-up document would be good enough, but the IRS isn’t that forgiving! You do need to submit original documents or certified copies from the issuing agency, so keep that in mind. Once your form and documents are all in line, your ITIN application will be smooth sailing.

Who Needs an ITIN?

You might be asking, ‘Do I really need an ITIN?’ and the answer largely depends on your individual circumstances. Typically, individuals who need to file a federal tax return but aren’t eligible for a Social Security number will require an ITIN. So, if you’re a non-resident alien working in the U.S. or a foreign national with income that is taxable, then yes, it’s quite likely you’ll need one. I remember when my cousin moved here from abroad, she was so confused about taxes; she thought she could just skip filing.

But nope, she ended up needing an ITIN to file her taxes correctly. One thing to note is that if you’re eligible for a Social Security number, then an ITIN isn’t for you. It’s specifically for those who aren’t. And don’t worry if you don’t have a tax return; there are ways to apply for an ITIN without one, so let’s keep moving along to those details.

Common Myths About ITINs

Let’s clear up some common myths surrounding ITINs because, believe it or not, there’s a lot of misinformation out there. First off, some folks think that having an ITIN makes you illegal in the U.S.—not true! An ITIN just helps you file taxes if you’re not eligible for a Social Security number. I’ve heard so many misconceptions like that, and it’s downright frustrating. People often believe that an ITIN can be used for anything beyond tax purposes, like accessing government benefits, but that’s false.

An ITIN cannot be used for that, and having one doesn’t grant you legal status. Another myth that drives me crazy is that you cannot apply for an ITIN without a tax return. Nope, you sure can! As long as you have the necessary justification and documents in hand, you’re all set. Debunking these myths is important—knowledge is power, after all, and it can definitely guide you on the right path.

After Receiving Your ITIN

Once you’ve successfully applied for and received your ITIN, it’s important to keep a few things in mind. You’ll need to use it annually for tax filings, so don’t just stuff that number away! I used to think that once I had my ITIN, I could just forget about it, but that’s totally incorrect! You have to file your taxes every year, and you’ll use that number on your returns. It’s pretty pivotal to renew your ITIN if it’s been inactive for three years; otherwise, it could expire, leaving you back at square one when you need it again.

Keeping track of its use is a good habit, and you should always store your ITIN documents in a safe place; no one wants to deal with lost papers during tax season, trust me! Also, it’s wise to treat your ITIN information securely, just as you would with your Social Security number. Being proactive in managing this can save you headaches and ensure smoother financial dealings in the long haul.

Applying for an ITIN Without a Tax Return

Applying for an ITIN without a tax return might sound tricky at first, but it’s totally feasible! What you’ll essentially need is to fill out Form W-7, which is the IRS application form for an ITIN. Make sure to check the box indicating you’re applying for an ITIN without a tax return. Along with that, you’ll need to provide some form of identification and documentation proving your foreign status and identity; think of passports or other government-issued documents.

When I first applied for mine, I was nervous about sending in my documents through the mail. Just imagine losing your passport; yikes! But the IRS does have procedures to return your documentation after they process your application. Bear in mind the waiting period varies but be patient! If everything is in order, your ITIN will usually arrive within a certain timeframe. This is an important step that can lead to easier financial transactions and complying fully with tax obligations, which, trust me, is so worth it.