Applying for an ITIN (Individual Taxpayer Identification Number) requires submitting the right identification and supporting paperwork to the IRS. Missing or incorrect documentation is one of the main reasons applications are delayed or rejected. This article on documents for ITIN application provides a complete checklist of what you need, including valid IDs, forms, and additional papers, to ensure your request is processed smoothly.

Proof of Identity Documents

The most crucial part of your ITIN application is proving your identity, and it can be a bit tricky if you’re not prepared. Just imagine standing in line at a government office, hoping you’ve brought everything but your string cheese – that’s the kind of state I found myself in once! You need to provide original documents or certified copies from the issuing agency, not just a simple photocopy. Passports are the best option since they’re universally accepted.

If you’re like me and your passport is expired – yikes – worrying won’t help! Instead, gather other documents like your national ID or driver’s license, and combine them with additional documentation such as your birth certificate or even your school records to make up for the lack. Keep all papers safe, because losing them can really mess with your timeline. It’s kind of like a treasure hunt, right? You want to ensure you have all the pieces to complete the puzzle… so let’s get those identity requirements checked off your list

The Key Documents Required

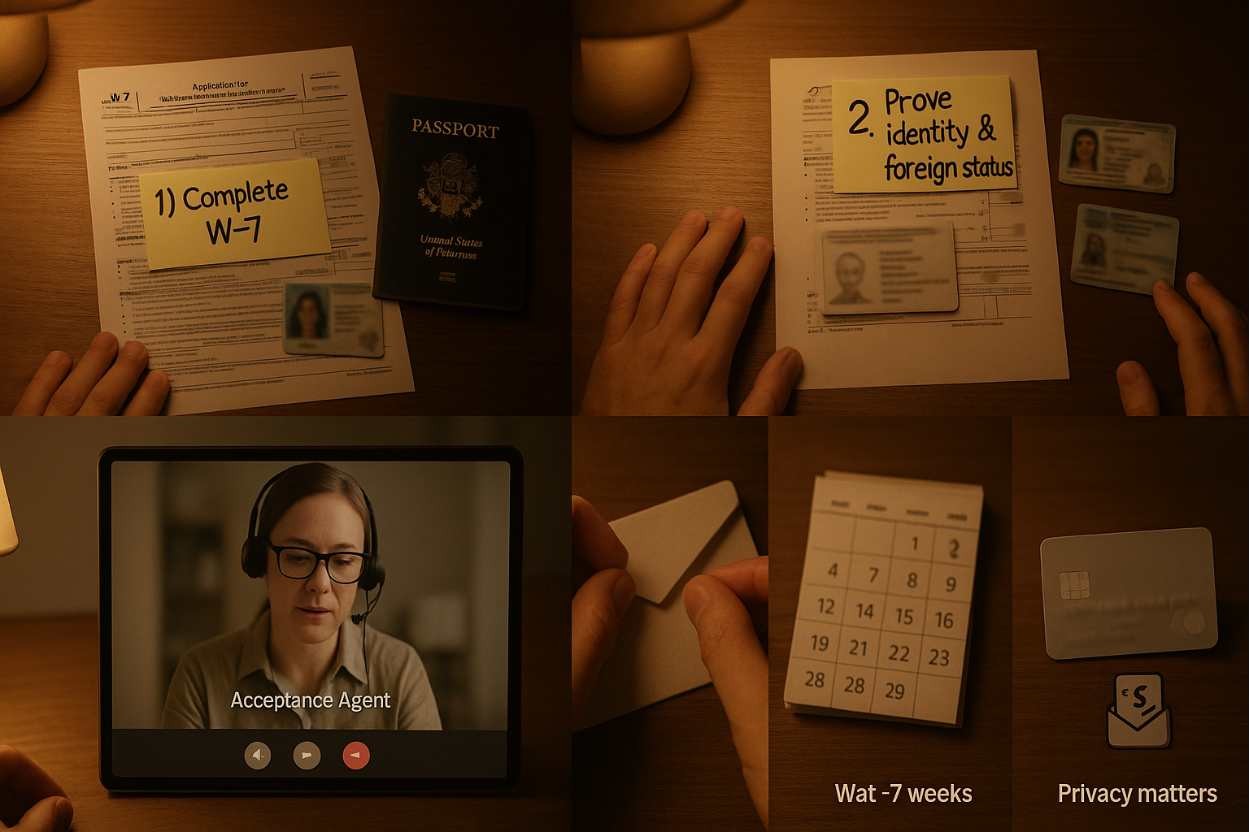

When applying for an ITIN, there are a few essential documents that you’ll need to prepare. It might feel like a scavenger hunt at first, but trust me, gathering the right materials will make your application smoother. First, you will need a completed Form W-7, which is basically your application for the ITIN. It may seem tedious, but filling it out accurately is super important to avoid delays. Secondly, you must provide proof of identity – for example, a passport is ideal because it’s a strong piece of evidence. If you don’t have a passport, you can piece together a combination of documents like a driver’s license and birth certificate, but just make sure that the documents are current.

Also, don’t forget to submit your tax return (or proof of income) when you apply. I once had a friend overlook this crucial step, which led to a longer wait time than necessary! Keeping all documents organized is key, so find a neat folder to hold everything together – trust me, your future self will be grateful for that little effort.

Tax Return and Income Proof

As if collecting identity documents wasn’t enough! You’ll also need to submit your tax return or proof of income, and it’s easy to overlook this detail. I can remember a rush of panic when a friend texted me while filling his application, and I realized he forgot this part! So, here’s the scoop: if you’re filing a tax return for the first time, you’ll need to include a completed Form 1040 or 1040-NR – these are essential forms that the IRS uses. Make sure you have these ready, or your application might be delayed.

If you’re applying for an ITIN solely to file your taxes, you will obviously need to include that return. If you haven’t filed taxes yet, don’t sweat it; just provide other proof of income. Documents like a bank statement, W-2 forms, or even pay stubs can work wonders too. It’s all about showing the IRS that there’s a reason behind your need for an ITIN, helping to paint a fuller picture of your tax obligations!

Common Mistakes to Avoid

We’ve all been there: the fine details can be a bit easy to overlook. While pursuing your ITIN, there are some common mistakes that folks make, and let me tell you, you don’t want to be one of them. For starters, ensure that your W-7 form is filled out correctly. A simple typo or forgetting to check a box can lead to serious delays. Also, double-check that all names and dates match across your documents. I tell you from experience; that little mismatch can raise flags.

Another mistake to watch out for is possible missing documents! You’d be amazed how often people think they’ve submitted everything, only to find out they left something crucial behind. Having a checklist handy while compiling everything can be a lifesaver. Also, remember to keep copies of everything for your records, because when you’re dealing with applications, it’s always better to be safe than sorry. It’ll save you heartache while navigating through the twists and turns of the IRS process!

Submitting Your Application

Once you have gathered all your documents for the ITIN application, the next important step is submitting it. You can send your application to the IRS directly, but be prepared, it sometimes feels a bit like sending a letter into a black hole! In actuality, it can take 6 to 8 weeks to receive your ITIN, so patience is a virtue here. A few years back, I submitted my niece’s ITIN application, and I remember constantly checking my mailbox as the weeks piled up. It felt suspenseful!

Alternatively, if you are feeling unsure about everything, you could seek help from a Certifying Acceptance Agent, which can really streamline the process. These agents are often equipped with the knowledge and experience to guide you effectively through your application. They can verify your identity too. Just don’t forget to double check the address to which you send your application before clicking ‘send’ or putting that envelope in the mailbox because trust me, one little mistake can cause unnecessary headaches with the IRS. Stay organized and good luck!