The ITIN (Individual Taxpayer Identification Number) is a tax ID created by the IRS for individuals who cannot obtain a Social Security Number but still need to pay taxes in the United States. Knowing how to get an ITIN is essential to comply with IRS rules, avoid delays, and access certain tax benefits. In this article, we explain who qualifies, which documents are required, and the steps to apply successfully.

Gathering Necessary Documents

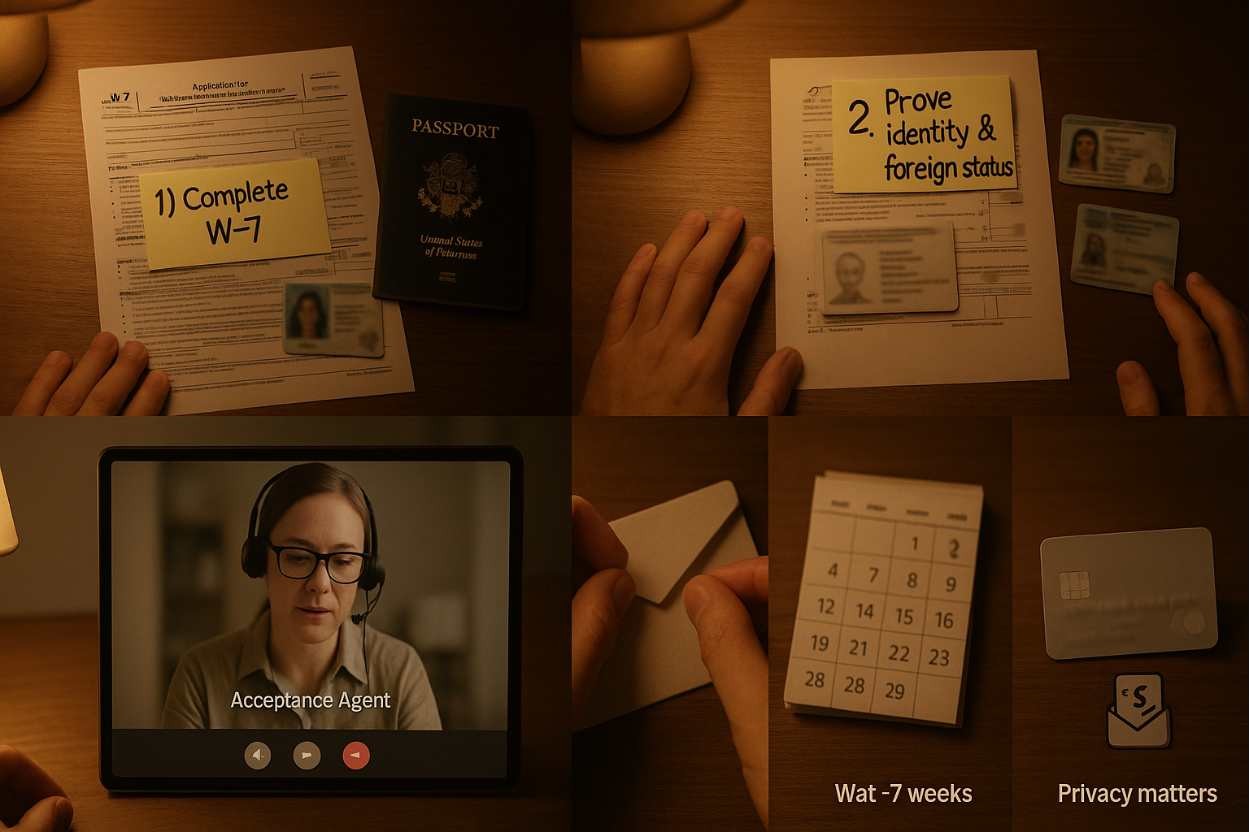

When applying for your ITIN, gathering the right documents is key—it makes all the difference! For starters, you need a filled-out Form W-7, which you can easily find on the IRS website. But that’s just the tip of the iceberg. You also need to provide documentation that proves both your identity and your foreign status. Commonly accepted documents include passports, national ID cards, or even a driver’s license. I recall when my brother applied for his ITIN; he didn’t realize that he could use his foreign passport as validation! It’s really smart to double-check which documents you’re using to ensure they are current and have necessary stamps if applicable.

Keep in mind, you need to submit these documents together with the W-7 form. It can slow down the process if you don’t—so be careful! Also, remember that all your documents must be in their original form or certified copies; photocopies won’t cut it. So, take your time, compile everything, and you’ll make your ITIN application a breeze!

Who Needs an ITIN?

So you might be asking yourself, ‘Do I really need an ITIN?’ The answer depends on your personal situation. Generally speaking, anyone who needs to file a US tax return and does not qualify for a SSN should consider applying for an ITIN. I remember when my cousin moved to the States from Brazil. She was eager to establish her life here but had no idea that she needed an ITIN for her part-time work. If you’re a foreign student, a spouse of a US citizen, or if you’ve been granted a visa, having an ITIN will help you file your taxes efficiently. It’s also important for dependents who don’t qualify for an SSN but still need to be claimed on tax returns.

Ultimately, having an ITIN simplifies tax reporting and keeps you in compliance with IRS rules. Plus, if you’re in a partnership or own a business, you’ll likely need one too. So, whether you’re working remotely or investing in real estate, understanding who needs an ITIN is crucial for navigating those tax waters smoothly.

Timing Your Application

So, let’s talk timing! The timing of your ITIN application can really impact your tax filing process, and it’s something you definitely should consider. Ideally, you want to start the application as soon as you know you’ll have to file a US tax return. This is especially true if you’re new to the US tax system or you’ve never applied for an ITIN before. When I first came to America, I didn’t account for how long these things could take and ended up rushing my tax return.

Not fun! Generally, it can take 4 to 6 weeks to obtain an ITIN even if everything is submitted correctly. If you’re close to a tax deadline, plan ahead and send your application early. Another option? If you intend to file a tax return that is due in the middle of the year, consider applying for the ITIN together with your return to streamline the process, just like I did later on. By being proactive, you’ll avoid any last-minute headaches and keep your finances in check.

Common Mistakes to Avoid

Everybody makes mistakes, but when it comes to applying for an ITIN, it’s crucial to avoid a few common pitfalls. One of the biggest errors people make is incorrectly filling out Form W-7. Trust me, it might seem simple, but missing a box or making a typo can delay your application. I learned this the hard way when I filled mine out the first time—oh boy, the frustration! Another common mistake is failing to provide the right identification documents or using copies instead of the originals. Remember, the IRS is pretty specific about requiring originals or certified copies of documents.

Additionally, be sure not to wait until the last minute to apply! As mentioned earlier, the processing might take time, so giving yourself a cushion really helps. Lastly, don’t forget to double-check your mailing address when submitting your application; it can be quite embarrassing if it doesn’t reach the right place! If you stay mindful about these common blunders, you’ll be on the right track to getting your ITIN smoothly.

How to Apply for an ITIN

Here’s the nitty-gritty: applying for an ITIN isn’t as daunting as it sounds! The application process is pretty straightforward. First off, you need to fill out Form W-7, which is specifically designed for ITIN applications. When I had to help my cousin with her ITIN, we found it helpful to gather her documents ahead of time. You’ll need to provide valid identification and documents to support your foreign status and identity, like a passport or a national ID.

Once everything is in place, you can either send your application via mail to the IRS or you might be able to get assistance through an IRS-authorized Acceptance Agent. Just keep in mind that the process might take a few weeks, so plan ahead! Oh, and don’t forget: if you’re applying for an ITIN along with your tax return, make sure you submit both together! This can help speed things up. Overall, it’s all about being organized and knowing what to expect—you’ll be all set in no time!