When planning to apply for an ITIN (Individual Taxpayer Identification Number), many individuals want to know the costs involved. The IRS itself does not charge a fee, but there may be expenses if you use a Certified Acceptance Agent, tax professional, or need document translations. Understanding the cost of obtaining an ITIN will help you prepare for the process and avoid unnecessary charges. In this article, we explain the fees, requirements, and what to expect when applying.

Common FAQs About ITIN Costs

When it comes to costs, many folks have common questions regarding ITINs. The most frequent one I hear is: “Is there an application fee?” The good news is that there is no application fee to obtain an ITIN directly from the IRS using Form W-7. However, if you’re hiring a certified acceptance agent, they may charge fees for their services, which can range quite a bit. Other questions include, “What if I make a mistake on the form?” If you do, unfortunately, that might delay the process, and you may find yourself needing help with resubmission. Lastly, many wonder if there’s a cost associated with renewing an ITIN.

The renewals are still free, but it’s essential to keep track of expiration dates because failed renewals can lead to unnecessary complications down the line. It’s clear that understanding what might come up can ease the process! Just keep asking questions and gathering solid info so you can get your ITIN without any unnecessary hiccups.

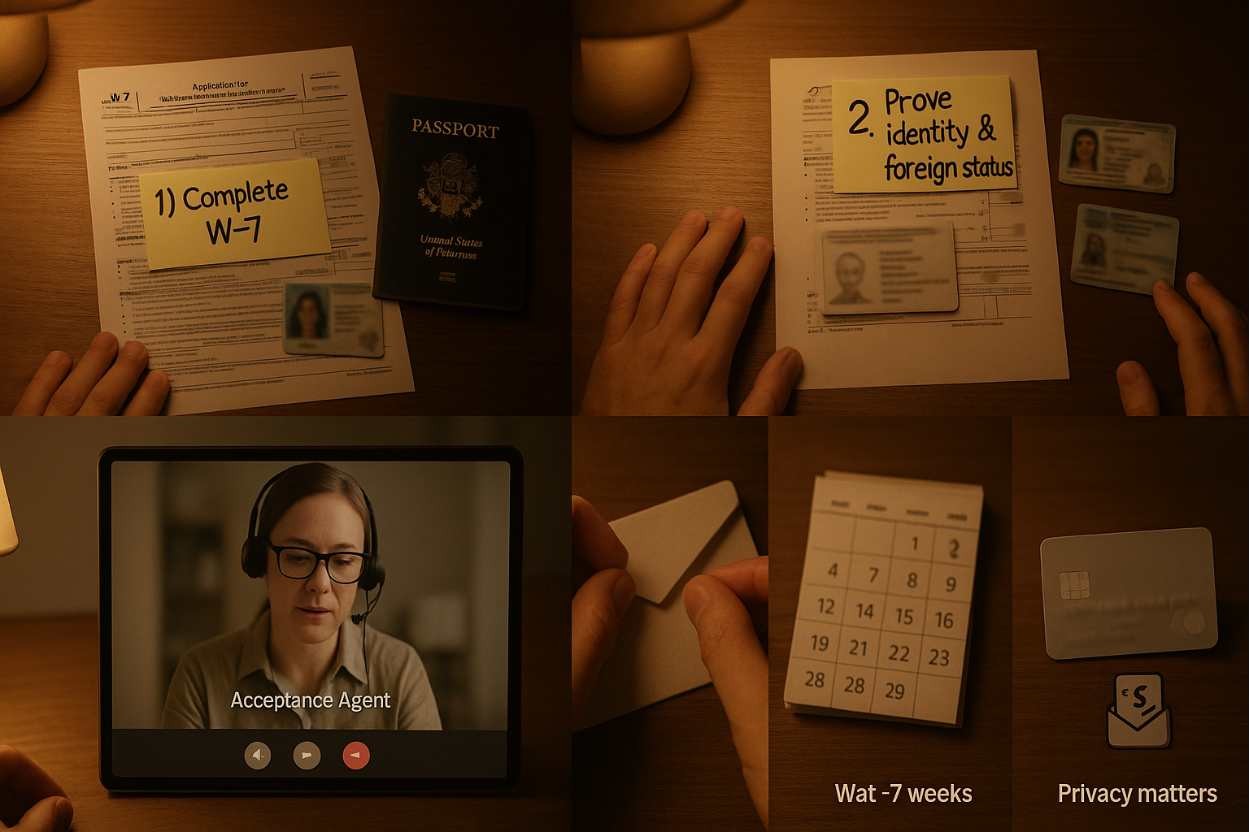

The Application Process

Obtaining an ITIN involves filling out Form W-7 and submitting it to the IRS, usually along with your tax return. The form itself is pretty straightforward but don’t forget that you might need supporting documents too, such as proof of identity and foreign status. There’s no fee to apply for an ITIN if you’re doing it yourself, which is great! However, some people choose to seek help from a tax professional—especially if the tax situation is complex. I once tried to do my friend’s application alone, but we realized we needed some guidance on the documentation, which took a little longer.

So, while the basic application doesn’t cost anything, you might end up paying for professional assistance. This could range from a couple of hundred dollars to more, depending on the service provider! It’s important to weigh the costs versus the benefits of DIY versus hiring someone, as having the right help could save you lots of time and hassle in the long run.

Additional Resources for Applications

If you’re looking into the costs and the application process for an ITIN, knowing where to find additional resources is invaluable! The IRS website is, of course, the best starting point because it provides all the necessary forms, instructions, and requirements. I remember pleasantly discovering their step-by-step guide—made my life so much easier! Besides that, local community centers sometimes offer free tax-help programs where volunteers can assist with your application at no charge.

Also, nonprofits that cater to immigrants might have affordable rates or even be able to help you completely for free! It’s really heartwarming to see communities coming together to support one another. Finally, checking in with local tax preparation services for any upcoming informational sessions could be beneficial too. So, use these resources freely; they can really make the process smoother while keeping costs in check!

Experience and Advice When Applying

Everyone loves a good story, right? Well, I want to share a little bit of my experience when I helped my friend with her ITIN application. First off, we printed out all the necessary paperwork and set aside an entire day just to tackle this. It was exhausting but actually kind of fun to turn this into a shared experience! We laid everything out and double-checked our documentation before putting it all together. One piece of advice I can give you, is to keep a copy of everything you submit—you never know what might be needed later.

After completing the whole process, we celebrated with pizza, feeling like we’d conquered a giant mountain together! It may feel overwhelming, but having someone to lean on really lightened the load, and now I’m more confident about the whole ITIN application process. So, if you can, enlist a friend or family member; it not only helps but can bring in some good moments that turn into lasting memories!

Hidden Costs to Consider

Beyond the obvious fees for applying, there are some hidden costs to consider when obtaining an ITIN. For example, when you’re gathering documentation, you might find that some papers need to be notarized or translated, which can rack up fees in an unexpected way. I learnt this the hard way when I had to get some documents translated for my friend; those bills added up quick!

Additionally, if you need help navigating your tax situation after getting your ITIN, hiring a tax advisor might become a recurring expense. It’s also worth mentioning that if you wait until the last moment to file, there could be rush fees involved if you need to expedite your application. Time really is money, and ensuring you submit everything correctly can save you those extra costs! Keep a careful eye on these potential expenses, and maybe create a little budget. It’s better to know exactly what you’re getting into rather than being hit with surprises.