How to Check ITIN Application Status

After submitting your ITIN (Individual Taxpayer Identification Number) request, it’s important to know how to follow up on its progress. Understanding how to check ITIN application status helps you confirm whether your documents have been received, if your case is still being processed, or if the IRS requires additional information. In this article, we explain […]

Understanding ITIN for Undocumented Immigrants

Even without legal immigration status, individuals in the United States may still need to report income and file taxes. For this purpose, the IRS issues the ITIN (Individual Taxpayer Identification Number). Applying for an ITIN for undocumented immigrants allows you to comply with U.S. tax laws, demonstrate financial responsibility, and in some cases access credits […]

The Easiest Way to Get an ITIN

The ITIN (Individual Taxpayer Identification Number) is a tax ID created by the IRS for individuals who cannot obtain a Social Security Number but still need to pay taxes in the United States. Knowing how to get an ITIN is essential to comply with IRS rules, avoid delays, and access certain tax benefits. In this […]

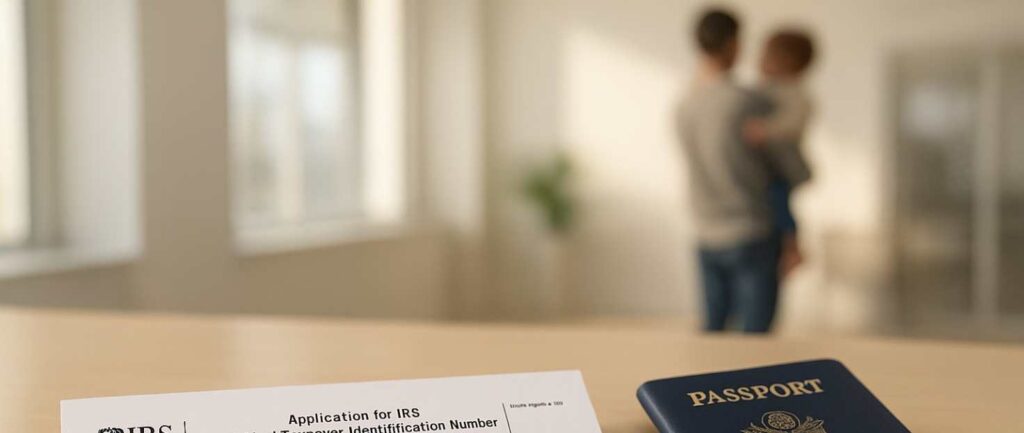

Understanding ITIN for Dependents

If your children or other relatives are not eligible for a Social Security Number but must be included on your U.S. tax return, they may need an ITIN (Individual Taxpayer Identification Number). Applying for an ITIN for dependents ensures they are recognised for tax purposes, allowing you to claim them, file correctly, and access possible […]

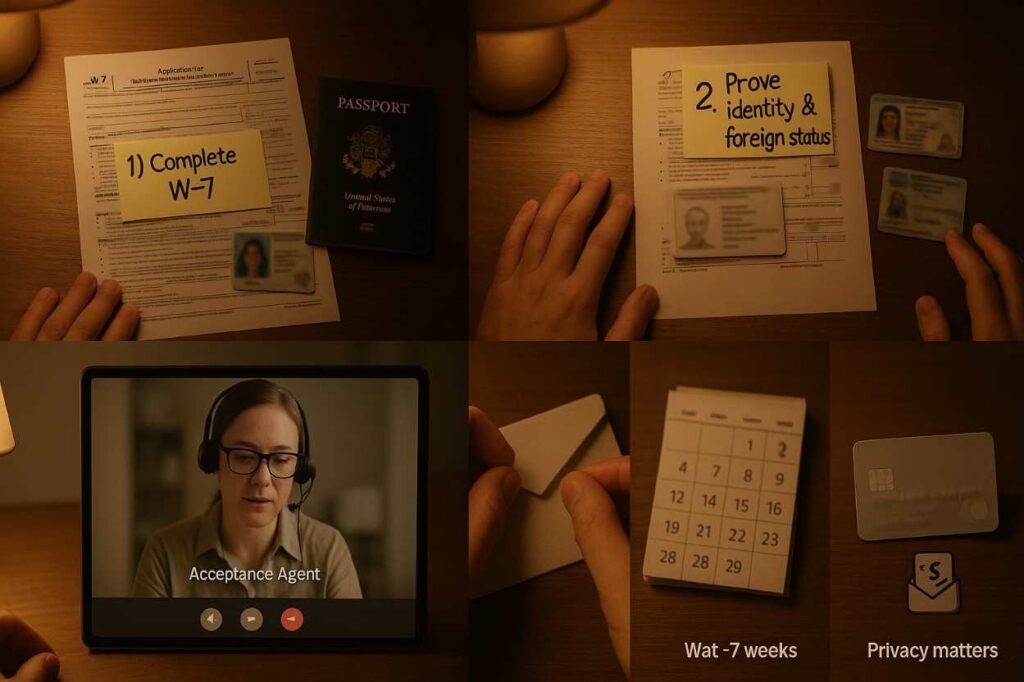

How to Make an Appointment for ITIN

The Role of Acceptance Agents Acceptance Agents play a crucial role in your ITIN application process. They are authorized by the IRS to assist individuals in obtaining their ITINs without needing to send their documents directly to the IRS, which can make things a lot easier. I relied heavily on an Acceptance Agent when I […]

How to Apply for an ITIN Without a Tax Return

Normally, the IRS requires applicants to attach a federal tax return when requesting an ITIN (Individual Taxpayer Identification Number). However, there are certain exceptions. Knowing how to apply for an ITIN without a tax return is essential if you qualify under categories such as dependents, certain visa holders, or individuals claiming treaty benefits. In this […]

Understanding the Cost of Obtaining an ITIN

When planning to apply for an ITIN (Individual Taxpayer Identification Number), many individuals want to know the costs involved. The IRS itself does not charge a fee, but there may be expenses if you use a Certified Acceptance Agent, tax professional, or need document translations. Understanding the cost of obtaining an ITIN will help you […]

Understanding ITIN for Non-Resident Aliens

Foreign individuals who earn income in the U.S. but are not eligible for a Social Security Number may need an ITIN (Individual Taxpayer Identification Number). Applying for an ITIN for non-resident aliens ensures compliance with IRS requirements, allowing them to report income and file tax returns properly. In this article, we explain who qualifies, what […]

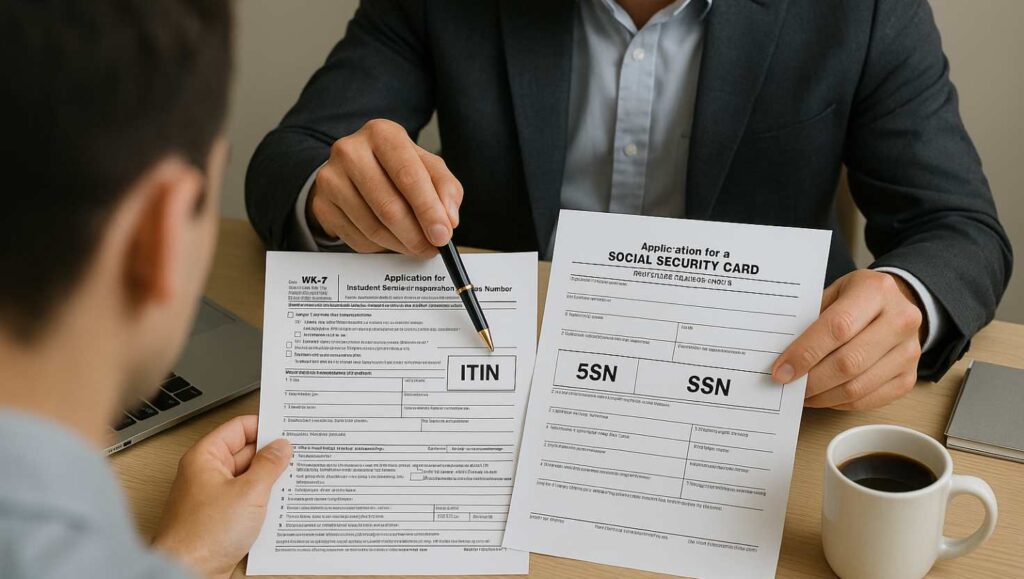

Understanding ITIN vs SSN

In the United States, the ITIN (Individual Taxpayer Identification Number) and the SSN (Social Security Number) are both used for identification and tax purposes, but they apply to different groups of people. Understanding ITIN vs SSN is key to knowing which one you need, how each works, and what role they play in taxes and […]

Understanding Tax Refunds with ITIN

Filing taxes in the United States with an ITIN (Individual Taxpayer Identification Number) can still make you eligible for certain credits, deductions, and even refunds. Understanding how tax refunds with ITIN work is essential to ensure you claim every benefit you qualify for while staying compliant with IRS rules. In this article, we explain who […]