Key Documents Required

When applying for an ITIN, you can’t just wing it! The IRS is pretty specific about the documents you need to submit. At a minimum, you’ll definitely need to provide proof of both your identity and your foreign status. The most commonly accepted document is a passport. However, if you don’t have one, other forms of identification may work, such as a government-issued ID card featuring your photo. I’m always reminded of how many people overlook this part. I once helped my cousin through this, and he nearly missed sending in the right document! In the end, he found a valid foreign driver’s license that worked.

Another crucial tip is that whatever documents you decide to submit, they need to be either originals or certified copies—don’t risk sending in regular photocopies, as that could lead to delays or even rejection. Plus, if you’re doing this aged over a certain length of time, remember that the documents can expire depending on the issuing country, so you want to make sure everything is current before you submit.

Who Needs to Apply?

You might be wondering, ‘Do I really need an ITIN?’ If you are a foreign national who needs to file a tax return in the U.S. but can’t get an SSN, then yes! Many people find themselves in situations where they might not be employed in the traditional sense, like freelancers or those receiving income from U.S. sources. I once met someone who was doing some amazing remote work for a U.S. company, but didn’t have an ITIN, and it created a whole slew of complications for tax filing. Additionally, if you are a non-resident alien or a spouse or dependent of a U.S. citizen or resident alien, you may also need an ITIN for tax purposes.

The great thing is, applying for an ITIN is relatively straightforward, and knowing the requirements upfront can save you a lot of needless stress. I can’t stress enough – proper documentation can really make the process smoother.

Submitting Your Application

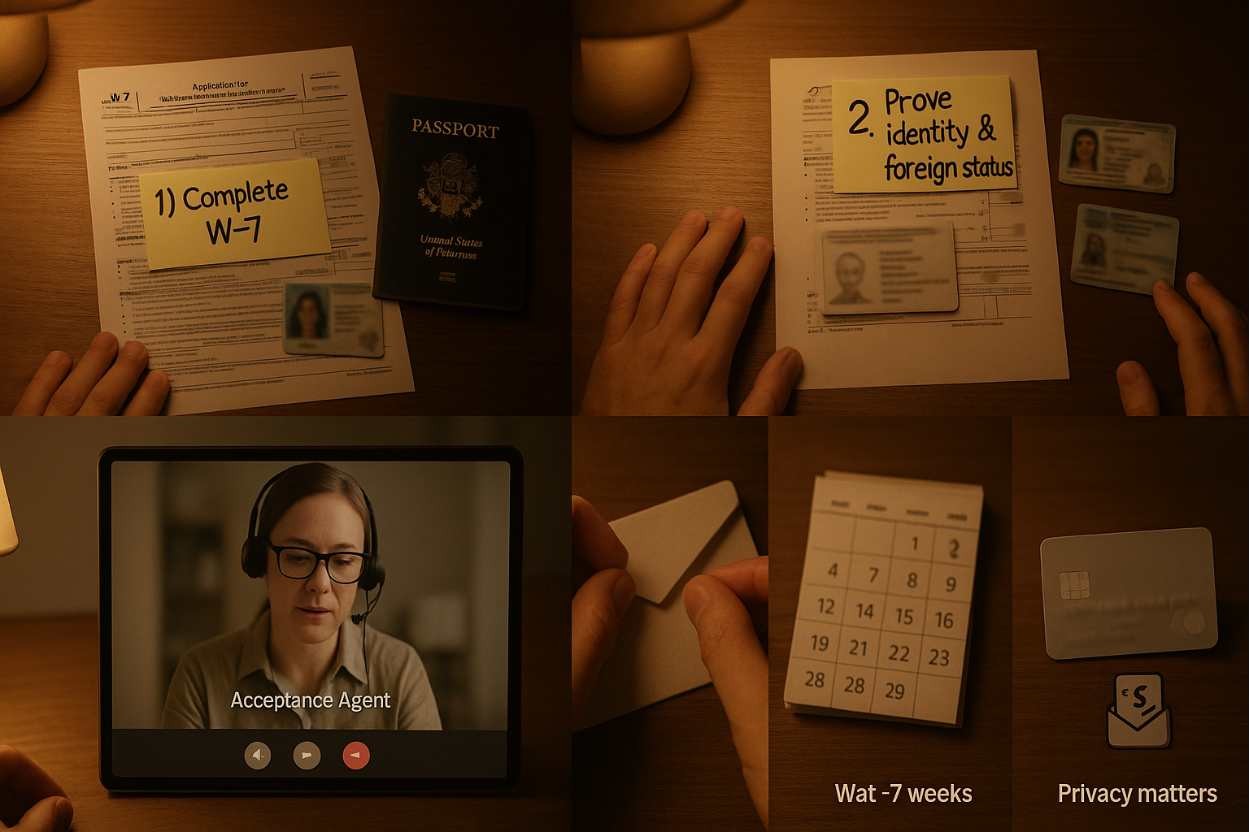

So, you’re geared up with your Form W-7 and supporting documents? Great! The next step, submitting your application, is where many folks get a bit nervous. You actually have a few options here, which is awesome. You can choose to mail your application directly to the IRS, and make sure you send it to the address listed in the instructions. Double-check that too, since it can change! Or, if you want a hand with that, you might opt for an IRS-authorized acceptance agent.

This was a lifesaver for me when I applied! They can guide you through the process and ensure all your documents are in order. Lastly, if you’re already filing your federal tax return, you can submit the W-7 form along with it. Just remember to clearly indicate that the application is attached. Oh, and it’s really important to follow up too. The process can take time. Waiting… waiting… But, trust me, when that ITIN number finally arrives, it’s totally worth it!

What to Expect After Applying

Once you’ve sent off your ITIN application, you might be curious about what’s next. It’s completely normal to feel a bit anxious during this time, but the good news is that the IRS usually processes applications within about 7 weeks, although it can take longer during tax season. Keep in mind, if there are any issues with your documents or the application form itself, it could delay the entire process.

So, I always recommend that my friends—ahem, and my cousin who went through this with me—make a copy of everything they send in. It’s one of those small things that can save a ton of hassle down the line. Once your application is approved, you’ll receive your ITIN via mail. Just imagine seeing that number and knowing you’re one step closer to fulfilling your tax obligations! In the meantime, if you haven’t already, it may also be a good time to familiarize yourself with your tax filing responsibilities, just to ensure you’re well-prepared for when tax time rolls around.

How to Apply for an ITIN

So, you’re ready to apply for your ITIN? The application process can feel a bit daunting, but trust me, it’s simpler than it sounds. First, you’ll need to fill out the Form W-7, which is the application for an IRS Individual Taxpayer Identification Number. You’ll want to have your original documents handy − those are crucial! The IRS requires proof of identity and foreign status, which can often be given through a passport, national ID card, or other official documents.

I remember scouring through my files trying to find the right papers—definitely felt like a treasure hunt!Once you’ve got your Form W-7 completed and the necessary documents together, you have a few options for submission. You can mail it directly to the IRS, apply through an IRS-authorized acceptance agent, or submit it with your federal tax return. Each method has its benefits, so choose the one that best suits your needs. Just remember to triple-check everything before you send it off to avoid delays!