After submitting your ITIN (Individual Taxpayer Identification Number) request, it’s important to know how to follow up on its progress. Understanding how to check ITIN application status helps you confirm whether your documents have been received, if your case is still being processed, or if the IRS requires additional information. In this article, we explain the ways to track your ITIN application, expected processing times, and what steps to take if delays happen.

Understanding ITIN and Its Importance

An Individual Taxpayer Identification Number (ITIN) is essential for individuals who are ineligible for a Social Security Number yet need to meet their tax obligations. Whether you’re a non-resident alien working in the U.S. or someone needing to file taxes for other reasons, an ITIN is crucial. I remember when I first applied for mine—I was preparing my taxes and realized I needed an ITIN to file correctly. This little number may seem like just a piece of information, but it opens doors to tax compliance and can even affect other aspects of your financial life. Using your ITIN can help you file your taxes accurately, receive tax refunds if applicable, and sometimes secure loans or credit.

Plus, having a valid ITIN can simplify your life when dealing with tax authorities. However, it’s not just about having the number; you must keep track of your application status to ensure you receive it in a timely manner. Taking the time to understand this process can significantly alleviate the stress of tax season, making it absolutely worthwhile to stay informed about your ITIN application status.

What to Expect After Applying

After submitting your ITIN application, patience is really the name of the game. It’s been noted that the IRS processes most applications within a period of six to eight weeks, but this timeframe can vary based on key factors like the volume of applications they are dealing with. I remember my friend who applied got hers back in just five weeks! However, it can be concerning if it seems like it’s taking longer than expected. During this waiting time, it’s important to check that all your documents are in order—any missing or erroneous details could potentially delay the process longer. So, take a moment to double-check!

Additionally, after receiving your ITIN, you should hang onto your ITIN assignment letter—this will contain vital information you may need in the future, especially when filing taxes. So be proactive, keep your documents organized, and remember that this process, while sometimes frustrating, ultimately leads to greatly valuable resources for managing your tax responsibilities. Staying informed can make all the difference in managing those waiting anxieties!

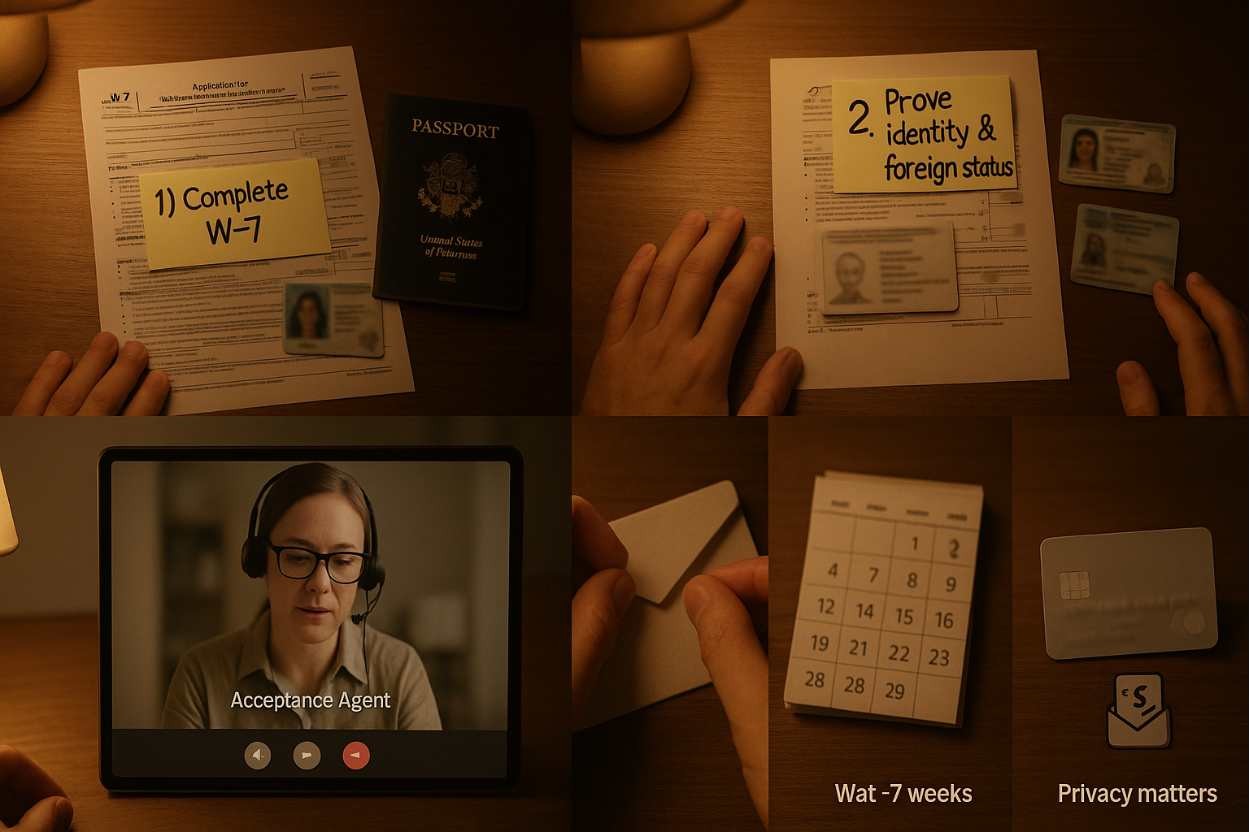

How to Submit Your ITIN Application

Submitting an ITIN application is relatively straightforward if you know what to do. First, you need to complete Form W-7, which is the application for an ITIN. I remember sitting at my kitchen table, filling out that form, making sure every detail was right. You’ll have to attach supporting documents, such as a passport or a birth certificate, to prove your identity and foreign status. Then, you can mail your application to the address specified in the form’s instructions or submit it in person at a Certified Acceptance Agent. Either way, get ready to exercise some patience! Once you’ve sent in your application, the IRS typically processes it within six to eight weeks. It’s a bit nerve-wracking, right?

I know I kept checking my mailbox every day, eagerly awaiting word back. That application process is key, as it paves the way for you to track your application status later on. Remember, you can’t check the status until you’ve gotten that initial confirmation from the IRS, so hang tight and breathe easy! You’ll get there, it just takes time.

Common Issues and Their Solutions

While the ITIN application process seems straightforward, common issues can arise, which can be super frustrating. One of the most frequent problems people face is a missing ITIN after the expected processing time has passed. If that happens, first don’t panic—call the IRS! Having the right information available when you call, like your application details, is so important. I recall being worried when my friend’s application disappeared into the void, but she was able to get answers quickly. Another issue could include rejection letters that cite reasons for delays or denials.

This could happen due to incorrect documentation or even mistakes on the application form itself. If that’s the case, it’s essential to carefully review the letter and correct any errors before you resubmit the application. Lastly, if you filed for an ITIN but have moved since then, make sure to inform the IRS of your change of address to avoid missing any important updates. Staying proactive and informed about these potential hurdles is the best way to minimize stress through the process!

Maintaining Your ITIN Status

Once you’ve successfully obtained your ITIN, it’s important to know how to maintain its validity. First off, keep in mind that an ITIN will expire if it’s not used for tax purposes for three consecutive years. So, even if you don’t need it every year, it’s good practice to file your taxes even if it’s just to keep your ITIN active. I learned this the hard way when I forgot to file one year and had to jump through hoops to renew it. To renew, you will need to again complete Form W-7 and submit the necessary documentation. Additionally, if your personal details change—say you change your name due to marriage—updating the IRS with those changes will help ensure your records are accurate.

Remember to check the IRS website regularly for any updates or changes in policies regarding ITINs, as regulations can shift. Staying engaged with your ITIN’s status can help you avoid any surprises in the future; it’s honestly a small effort that pays off big time with peace of mind!

Checking Your ITIN Application Status

Once you’ve sent in your ITIN application, knowing how to check its status can save you from unnecessary anxiety. The IRS offers a few ways to check your application status. The primary method is to call the IRS at their toll-free number. Speaking with a representative can provide direct insight into your application status, and honestly, I found talking to someone made the waiting feel less lonely. Make sure you have your personal details ready—things like your name, date of birth, and the number you provided on the form. That’ll help speed up the process significantly.

Alternatively, if you’d prefer a more hands-off approach, you can also check the IRS website to see any updates they might have posted about your application. However, do keep in mind that online checking may not always be available, so don’t rely solely on that. Whichever method you choose, be sure to write down any reference numbers or information you receive, like I did when I finally got the call about my status—it could come in handy for future inquiries!