Filing taxes in the United States with an ITIN (Individual Taxpayer Identification Number) can still make you eligible for certain credits, deductions, and even refunds. Understanding how tax refunds with ITIN work is essential to ensure you claim every benefit you qualify for while staying compliant with IRS rules. In this article, we explain who can get a refund with an ITIN, which documents are required, and the steps to claim your money back.

Common Tax Deductions for ITIN Users

When you’re a taxpayer with an ITIN, knowing what deductions to claim on your tax return can significantly impact your refund. It’s so easy to overlook the potential savings! For instance, if you’re a student—whether you’re in college or taking an online course—you might be eligible for deductions related to tuition and education expenses. I remember my sister snatching a great refund simply because she claimed her student loan interest! There are also deductions related to child and dependent care expenses, which can be a big help in balancing your family budget.

Additionally, if you itemize deductions rather than taking the standard deduction, you could claim expenses like mortgage interest and medical bills, which can add up quickly. I sometimes forget how much I spent on medical bills in a year, but pulling those together can really make a difference. Just keep in mind to have proper documentation for everything! Every deduction you can claim brings you closer to maximizing your refund potential, and who doesn’t want that?

Can You Get a Tax Refund with ITIN?

Absolutely, you can receive a tax refund with an ITIN! Many people think that having an ITIN means they can’t claim refunds, but that’s a myth. If you’ve had income subject to taxes, and you file your tax return with an ITIN, you could be eligible for a refund if you overpaid. I remember when I learned about this; my friend, who recently got his ITIN, was worried he’d never see a dime back from the IRS. I reassured him that it’s all about accurately reporting your income and claiming the deductions and credits you qualify for.

You know, there are several tax credits available, like the Earned Income Tax Credit (EITC) that can benefit low- to moderate-income workers—even with an ITIN! Just be mindful that it’s vital to file your return on time, as late filings can affect your eligibility for a refund. So, if you’re eligible and file correctly, keep your fingers crossed for a fat refund check!

Tax Credits Available for ITIN Holders

Tax credits are like golden tickets when it comes to reducing your tax bill, especially for ITIN holders. The best part? These credits can sometimes provide a substantial refund! For example, the Child Tax Credit is available for those with qualifying children and could provide a hefty reduction in your tax below. There’s also the American Opportunity Tax Credit for those in higher education—this can cover a portion of expenses related to tuition and more! My friend took a few classes and was over-the-moon about the credit she got back. Furthermore, if you’re working, you may also qualify for the Earned Income Tax Credit (EITC).

This is huge for low-to-moderate-income earners, creating a potential refund opportunity. One important note is that before claiming these credits, it’s a good idea to check the eligibility criteria, since they can be pretty specific. The tax landscape can be a little tricky. Just keep an eye on it and make sure you’ve done your research! You might be pleasantly surprised at how much you can claim.

Challenges Faced By ITIN Taxpayers

Though having an ITIN opens doors to tax filing, it can come with its own set of challenges. One of the biggest hurdles I’ve seen people face is navigating the complex landscape of tax codes and regulations. It can feel overwhelming—it certainly was for me the first time I filed! Additionally, there can be confusion about eligibility for certain credits and deductions, which I found perplexing when I was trying to max out my return. Picture trying to solve a jigsaw puzzle without the full picture—frustrating, right? Another challenge is the lack of access to some tax preparation resources, especially for those who might not be fluent in English or who are unfamiliar with the filing process.

It’s vital to seek out help if needed, whether it’s through a tax professional or community organizations that offer free assistance. And then there’s the issue of potential delays; processing refunds for ITIN holders typically takes longer. So if you’re planning to file, it’s wise to start early! Patience is key in this financial game!

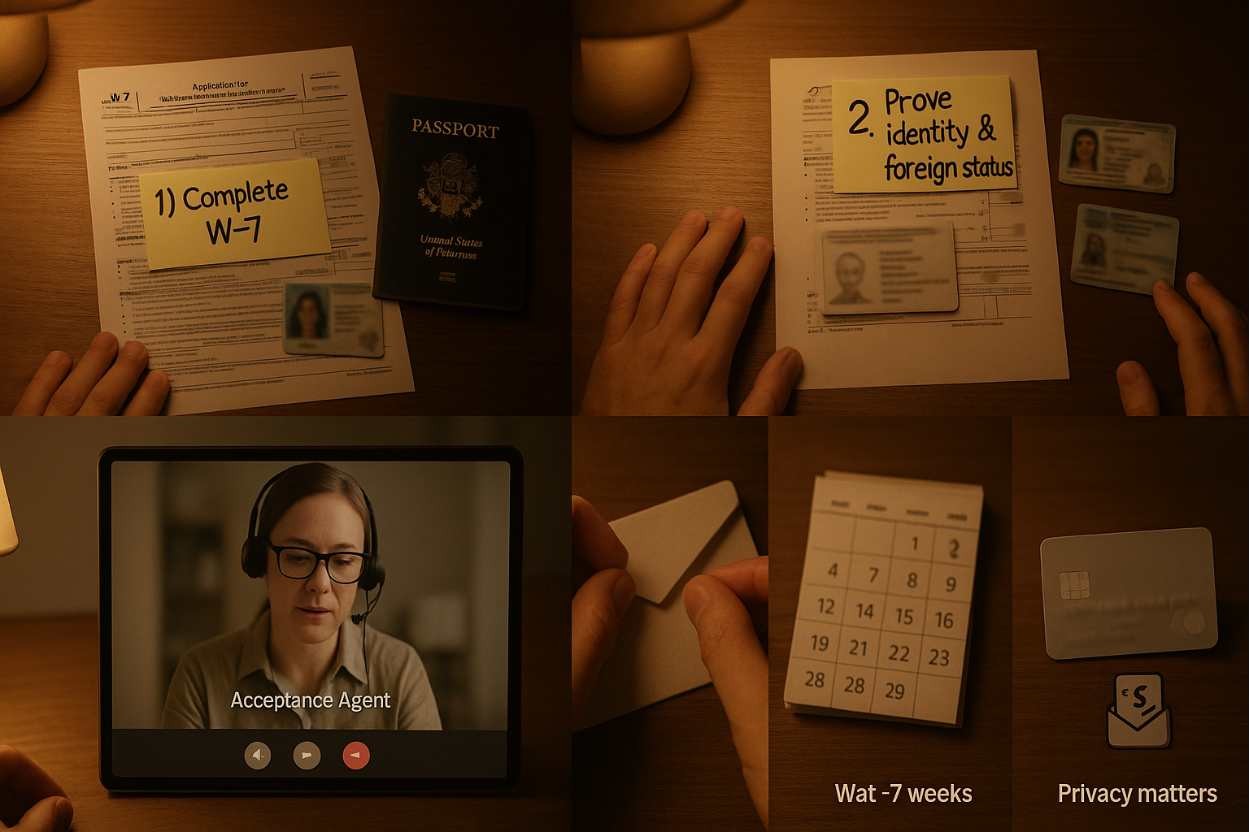

How to File Taxes with an ITIN?

Filing your taxes with an ITIN can seem daunting at first, but I promise, it’s not as scary as it sounds! The key here is organization. Start by gathering all your necessary documents, like your W-2s or 1099s, which show your income, and any other supporting materials. I’ve found it super helpful to create a checklist before I begin. Also, don’t forget about deductions—those can really lower your taxable income and increase any refund you might get. When you’re ready, you can either file your tax return online or through mailing it in. Many popular tax software programs allow ITIN users to file, which is great.

Just ensure that you choose the right software that explicitly mentions support for ITINs. If you’re unsure, consulting a tax professional can be beneficial too. They can help ensure you’re maximizing your refund and navigating all the potential credits you might qualify for. It’s like having a guide when you’re exploring a new city! Taking that first bit action can lead you to a more comfortable filing experience.