Not everyone needs an ITIN (Individual Taxpayer Identification Number), but for many individuals who cannot get a Social Security Number, it is essential for filing taxes in the U.S. Understanding the ITIN number qualifications helps determine if you are eligible, what documents you need, and how to apply. In this article, we explain who qualifies for an ITIN, the IRS requirements, and the steps to complete your application successfully.

Benefits of Having an ITIN

Now you might ask, why should I even bother with an ITIN? Well, let me tell you – the benefits are pretty solid! For starters, having an ITIN allows you to comply with federal tax laws in the U.S., which is super important. Nobody wants to end up in hot water with the IRS, right? Plus, being able to file your taxes gives you access to potential tax refunds! Seriously, how cool is that? It’s almost like getting a gift from yourself.

I’ve seen many people miss out on this just because they didn’t have the right documentation. Additionally, having an ITIN can help open doors to banking services. Some banks require a taxpayer ID for you to open an account, and an ITIN fits the bill perfectly. Picture yourself being able to manage money, even if you’re not applying for a credit card or loan; it’s refreshing, to say the least. When I finally helped my friend get his ITIN, he could open a bank account, and the relief on his face was priceless. Who wouldn’t want that feeling?

Who Needs an ITIN?

You might be wondering, who really needs an ITIN anyways? Well, there are several different scenarios where having one becomes essential. For instance, if you’re a non-resident alien and you earn income in the United States, even if it’s from just a one-time gig, you’ll need an ITIN to file your taxes. It’s almost like a badge that says, ‘Hey, I’m here, and I’m paying my dues!’ Also, individuals who are dependents of a US citizen or resident but do not qualify for an SSN may also require an ITIN.

And let’s not forget about foreign investors! If you own property or investments in the U.S., you’ll want to get your hands on an ITIN to ensure that you’re compliant with the IRS. I once met a friend who had invested in a small business in the U.S. He couldn’t get an SSN since he was living abroad, so he quickly applied for an ITIN to handle his taxes. Just imagine the relief it brought him! So, yeh, if you fit into any of these categories, an ITIN is kinda a necessity!

Common Misconceptions about ITINs

Oh, let’s talk about some common misconceptions about ITINs! One of the biggest myths is that an ITIN provides work authorization in the U.S. Spoiler alert: it doesn’t! Having an ITIN is only about tax purposes; it won’t grant you the right to work legally in the country. You really need a work visa for that. It’s crucial to spread that message because misunderstandings like these can lead to potential legal trouble!

Another misconception folks have is that an ITIN can somehow affect immigration status. Not true at all! While obtaining one isn’t the pathway to residency, having an ITIN does help in filing taxes correctly. I’ve even heard some people thinking their ITIN expires. That’s not quite accurate; while your ITIN may become inactive if not used for several years, it doesn’t just vanish! As always, it helps to speak with professionals to have the right info. Trust me, it can save you lots of confusion down the road and keep those myths at bay!

Important Considerations with ITINs

Alright, let’s wrap this up with some important considerations regarding ITINs. First off, keep in mind that an ITIN is for tax reporting only; it doesn’t replace an SSN or serve other purposes. So, when you’re thinking about applying, don’t expect it to unlock other doors, like job applications! Another thing worth mentioning is that even though it doesn’t expire, the IRS does require that you file taxes at least once every three years to keep it active.

So don’t be lax about those tax forms! I’ve had friends who thought they could just get an ITIN and forget about it – it doesn’t quite work that way! Lastly, if you’re considering applying for residency in the future, remember to keep your ITIN usage separate from your application process. Although it doesn’t affect that process, having clear documentation is always a plus. So, in summary, while an ITIN is super helpful, it’s essential to stay informed and be proactive about managing and respecting what it represents. Better safe than sorry, right?

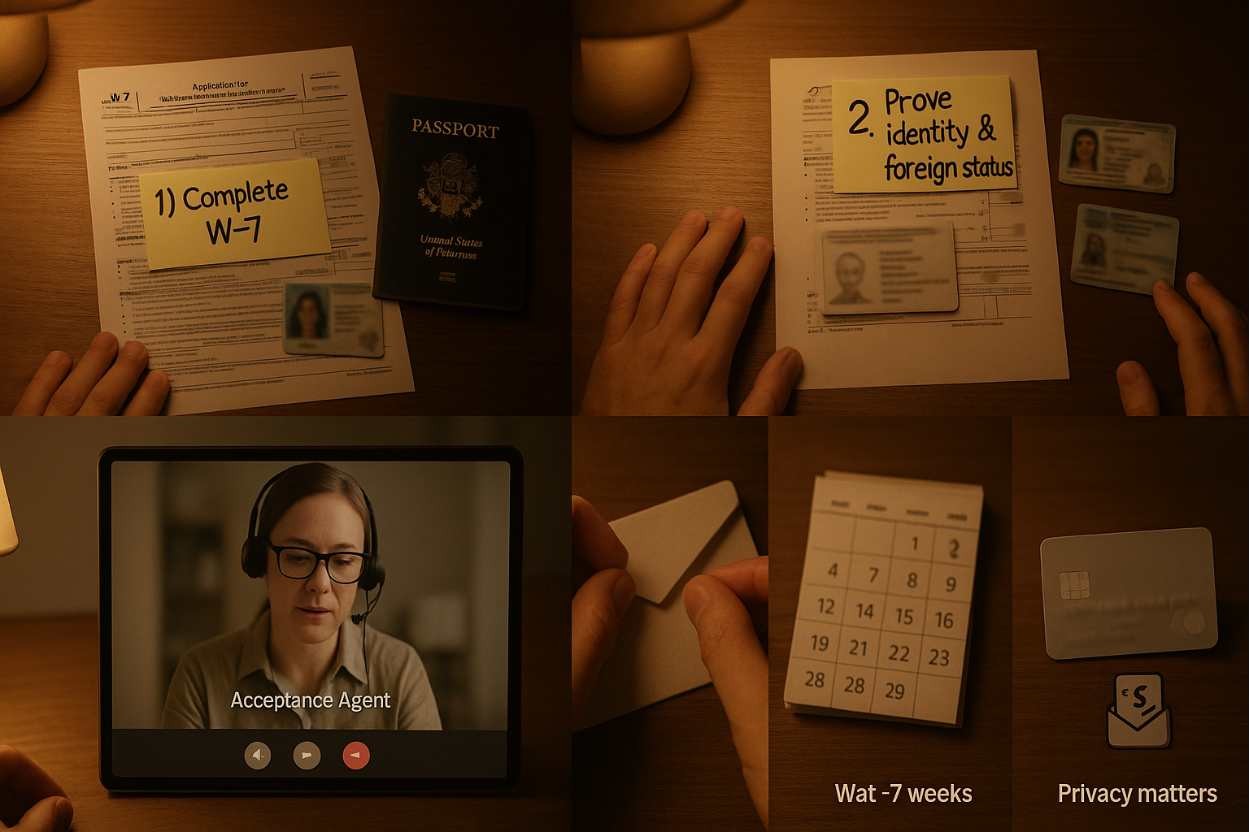

How to Apply for an ITIN

So, you’ve decided that getting an ITIN is the right move for you, now what? Applying for an ITIN might sound complicated, but it’s quite straightforward! First, gather all necessary documents; you’ll need to combine your form W-7 (which is the actual application form) with identification documents proving your foreign status and identity. These documents can be, say, your passport or another form of ID that the IRS accepts. After that, it’s just a matter of submitting your application! You can send it directly to the IRS, but there’s also the option of getting an Acceptance Agent to help you out.

I recommend searching for a local agent because having someone walk you through the process can really make a difference! And hey, once your application is approved, the IRS will send you your unique ITIN, usually within about six to eight weeks. So, hold tight! It can feel a bit daunting, but with the right preparations, you’ll have your ITIN in no time! Just like my cousin who breezed through the process, and now he’s ready for tax season with no worries!